Walk into your neighborhood supermarket and you’re likely to find the prices of basic food items much more expensive than they were five years ago or even last year. Everyone understands how inflation works – the price of goods and services goes up. Yet not many understand how inflation affects interest rates, and vice versa. When analyzing interest rates vs inflation, it’s worth understanding the relationship between the two and how to be best prepared to dominate no matter which way they move.

How Interest Rates are Determined

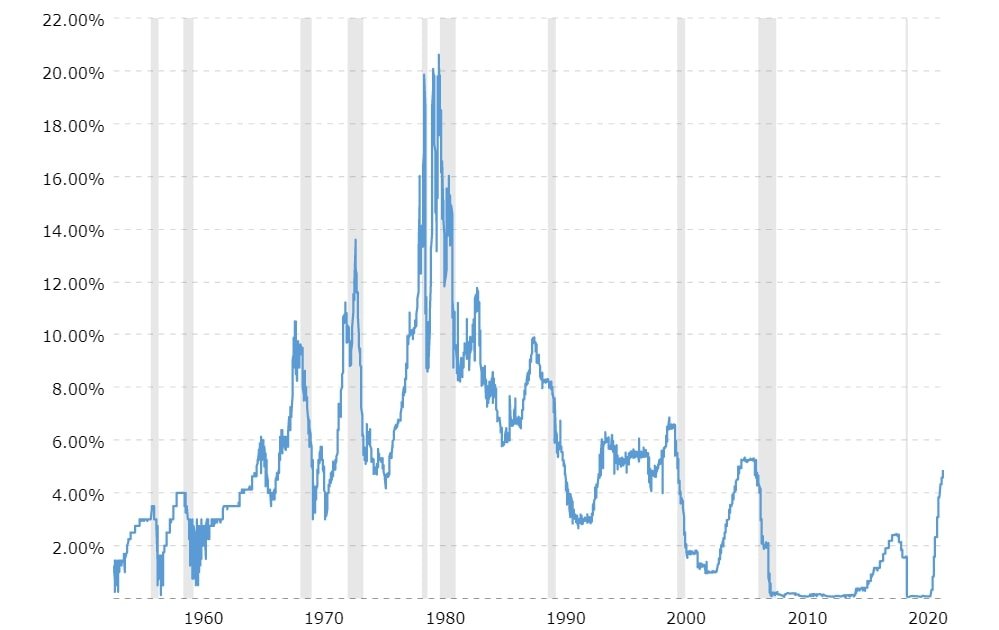

Central banks around the world have a superpower with which they control the money supply, and by extension, the entire economy. That superpower is the ability to decide what the interest rates levels are going to be. For example, the US Federal Reserve meets 8 times each year to set the Federal fund rates or the interest rates at which commercial banks lend from one another.

As the chart shows, interest rates dropped dramatically in the aftermath of the 2008 recession. With the global economy in crisis due to the collapse of Lehman Brothers and other high-profile failures, the Federal Reserve cut interest rates so that businesses and consumers could borrow, spend and stimulate the economy.

While the trick worked, the Fed forgot to raise the rates back up again once the economy stabilized. Only in 2019 did the Fed start raising rates again. However, the COVID crisis that occurred in the following year meant the Fed had to spring back into action and lower rates again. This time, the Fed doubled down on its monetary expansion by lowering interest rates and pumping trillions of dollars worth of new money into the economy. The result, unsuspectingly, was runaway inflation.

How Is The Inflation Rate Calculated: Understanding the Consumer Price Index (CPI)

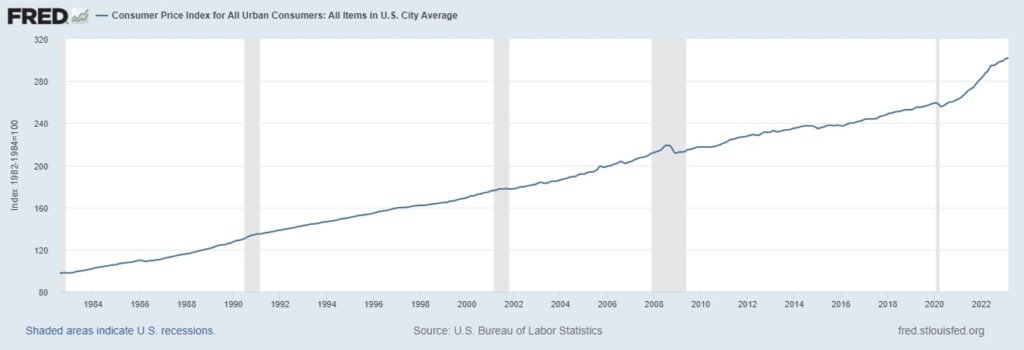

Economists use the Consumer Price Index (CPI) to calculate inflation. To calculate the CPI, economists select a basket of goods and services typically consumed by households, such as food, housing, transportation, and healthcare, and compare prices to a ‘base price’. That base price is the average price of goods and services in the years 1982-1984.

To illustrate this calculation, let’s take a look at the CPI reading for March 2023 and compare it to the year before.

In March 2023, the CPI was 301.808. In March 2022, the CPI was 287.472.

The yearly inflation is calculated as:

Inflation = (March 2023 CPI – March 2022 CPI)/March 2022 CPI x 100

Inflation = (301.808 – 287.472)/287.47 x 100 = 5%

Another interesting statistic to note is the fact that a CPI reading of 301.808 in March 2023 means that the cost of living has increased 3x since 1982

Using CPI to measure inflation has a few limitations such as:

- Substitution bias: The CPI does not account for the substitution of goods and services that occurs when consumers change their spending patterns in response to price changes. For example, if the price of beef increases significantly, consumers might substitute chicken or other protein sources. The CPI may overstate inflation by not accounting for this substitution effect.

- New products and services: The CPI may not fully capture the introduction of new products and services that did not exist during the base year. This can lead to underestimation or overestimation of inflation, depending on how the prices of these new products and services evolve.

- The current cost of living crisis: 2021 and 2022 saw the biggest 2-year jump in inflation since the 1970s. Nevertheless, you get a sense that the official numbers are underreporting the sheer scale of inflation that has ravaged the purchasing power of our puny pounds (and dollars and euros and yens etc.) For example, the cost of ground beef at my local butcher has shot up by 66% in the last 2 years.

Why is Everything So Expensive?

Ever since the COVID-19 crisis, the cost of living in most countries has shot up ridiculously fast. Cars, housing, beef jerky, vacations – everything is significantly more expensive than it was before we went indoors and put on masks to fight the virus.

To understand the reason why we’re forking out so much for goods and services, we have to trace back to March 2020, the day COVID brought financial markets to their knees. Governments around the world scrambled to contain the pandemic’s economic fallout by turning on the money taps and dropping interest rates all the way to zero. Stimulus packages and increased spending pumped trillions of dollars into the economy. While these measures helped keep the markets afloat, the consequence of having so much new money chasing a limited amount of goods and services meant that inflation would soon surge.

Understanding the Relationship Between Interest Rates vs Inflation

The interest rate in a given country is a variable its central bank can control and has a profound impact on inflation, which is obviously uncontrollable and left to market forces to decide.

- When interest rates are low, the cost of borrowing is low and therefore businesses and individuals tend to borrow and spend more. This could lead to inflation as an increased amount of capital chases a similar amount of goods and services.

- Once inflation rises, the Fed tries to slow down spending by making it more expensive to borrow money. They achieve this by raising interest rates.

How to Profit From Rising Interest Rates

When interest rates are rising, it’s probably a result of the Federal Reserve’s desire to curb inflation. Unfortunately for most workers, a rise in prices doesn’t equate to a rise in wages. As the graph below shows, real wages actually fell since the COVID-19 crisis.

To add insult to injury for the average Joe clipping a paycheck, the Federal Reserve has made it clear that interest rates are going to rise for the foreseeable future in order to combat inflation. Mr. Joe’s income might not rise, but he does have a few options at his disposal that will allow him to capitalize on the rising interest rates. Typically, periods of high-interest rates tend to benefit two types of assets:

- Fixed-income assets get a boost from the rising interest rates as they can now pay a higher yield to investors. For example, US Treasury Bills, widely regarded as the most secure investment one can make, now yield over 4% per year.

- Assets that act as a hedge against inflation tend to attract investors in periods where interest rates rise to fight inflation. For example, those who invested in gold last time we had crazy high rates of inflation back in the 70s won big. Today, the precious metal is joined by its digital cousin, Bitcoin, in the inflation-hedge category.

When interest rates are rising, it’s also important to know what to avoid:

- Rising interest rates may dampen the demand for commodities used in production, making it less attractive to invest in copper stocks or other commodities such as aluminum.

- Taking out a loan in a high-interest-rate environment is also challenging.

Inflation & Interest Rates FAQ

How to combat inflation?

Central banks fight inflation by raising interest rates, making it harder to borrow and spend money and thereby slowing the pace of the economy to keep prices down. As an individual, your best move to combat inflation is to reduce excessive spending, invest wisely, and seek new ways to increase your income.

Why raise interest rates when inflation is high?

Higher interest rates reduce inflation, making it more expensive to borrow and spend money, a behavior which contributes to the rise in inflation.

Does inflation affect interest rates?

When inflation is high, central banks will use interest rate hikes as the main tool in their arsenal to bring down inflation.

What is the relationship between interest rates and bond prices?

The relationship between interest rates and bond prices is an inverse one. When interest rates rise, bond prices generally fall, and when interest rates fall, bond prices generally rise.

What is the relationship between inflation and interest rates and exchange rate?

In theory, lower interest rates make it easy to borrow and spend, which could lead to inflation. It also makes the country’s currency less attractive for savers. On the other hand, higher interest rates make borrowing more expensive, which can slow down consumer spending and business investments, ultimately reducing the demand for goods and services. This, in turn, helps control inflation while making the country’s currency attractive for investors seeking yield.

In practice, we see a strong correlation between interest rates in different parts of the world. Just as the US has hiked rates in the wake of inflation, so too have most major countries done the same. In times of high interest rates and high inflation, like we’re seeing today, investors tend to flock to the safe haven of the US dollar.